Explore web search results related to this domain and discover relevant information.

The land survey equipment market has long been at the heart of infrastructure development, resource management, and geospatial mapping. Surveyors relied on manual instruments and complex fieldwork to measure land boundaries, topography, and resources. With the rise of artificial intelligence, ...

The land survey equipment market has long been at the heart of infrastructure development, resource management, and geospatial mapping. Surveyors relied on manual instruments and complex fieldwork to measure land boundaries, topography, and resources. With the rise of artificial intelligence, the industry is undergoing an extraordinary transformation.AI enabled software is reshaping how collected data is analyzed, processed, and applied across multiple industries including construction, mining, agriculture, and environmental monitoring. This blog provides a detailed exploration of how AI is influencing the land survey equipment market, expanding across applications, innovations, and future outlook.One of the most significant breakthroughs AI brings to the land survey equipment market is the acceleration of data collection and processing. Traditional surveying required days or weeks to gather sufficient data for projects such as road construction or land development.One of the greatest advantages AI brings to the land survey equipment market is cost efficiency and time optimization. Survey projects that once required large teams of field workers can now be managed with fewer personnel thanks to AI driven automation. AI reduces the need for manual interventions, allowing surveyors to cover larger areas in less time.

Only 28% of land brokers describe demand as strong, down sharply from 76% a year ago and marking a steep reversal from the past two years.

Market yield on U.S. treasury securities at 10-year constant maturity. Updated daily.Data sourced from FRED ... The U.S. land market is rapidly losing momentum, with demand falling to levels not seen since late 2022, according to Q2 2025 data from John Burns Research & Consulting.Analysts say lower construction costs have enabled builders to pay more for land — even as profitability narrows. Scarcity of developed lots has also propped up pricing. Still, the widening gap between what sellers want and what builders are willing to pay has slowed transactions, according to local real estate professionals quoted in the report. “I sense our market is in a bit of a standoff.In San Diego, a broker said the market has “deteriorated quickly.” · “Absorptions are down, and builders are raising their required returns, thereby affecting the prices they can pay,” they said. With conditions shifting, land buyers have begun to secure better terms — including delayed lot purchases and restructured contracts.Land banking — where investors control lots without immediate market risk — continues to expand.

Explore New York land for sale on Land.com, featuring diverse properties from Adirondack mountain retreats to fertile Hudson Valley farmland, Finger Lakes vineyard sites, and Catskill recreational acreage. Discover the Empire State's unique combination of natural beauty, agricultural potential, and proximity to major markets...

Explore New York land for sale on Land.com, featuring diverse properties from Adirondack mountain retreats to fertile Hudson Valley farmland, Finger Lakes vineyard sites, and Catskill recreational acreage. Discover the Empire State's unique combination of natural beauty, agricultural potential, and proximity to major markets, with properties suitable for farming, recreation, timber production, and country estates.New York State offers remarkable diversity in its rural land market, spanning from the vast wilderness of the Adirondack Mountains to the fertile agricultural valleys of the Hudson River and Finger Lakes regions. The Empire State encompasses varied landscapes across its 54,475 square miles, including dense forests, rolling hills, productive farmland, and numerous lakes and waterways.For outdoor enthusiasts, New York offers exceptional hunting land for deer, turkey, and small game, while waterfront properties along the state's numerous lakes, rivers, and streams provide outstanding recreational opportunities. Land.com's marketplace connects buyers with sellers throughout New York's diverse regions, from the Canadian border to the Pennsylvania state line.The sellers are also willing to negotiate terms for seller financing. This is your opportunity to own a slice of history and pastoral beauty in the heart of Pleasant Valley, NY. This 138.4-acre dairy farm combines fertile land with panoramic views an

A pair of properties at opposite ends of north Mayo are presently on the market. The larger of the two sells by public auction in late September.

× This content is copyright protected! However, if you would like to share the information in this article, you may use the headline, summary and link below: Title: Sizeable Mayo land parcels on the market A pair of properties at opposite ends of north Mayo are presently on the market.The larger of the two sells by public auction in late September. https://www.farmersjournal.ie/sizeable-mayo-land-parcels-on-the-market-883320Lot 1 contains 14.6ac that is split into two long strips of good, self-draining land. On the larger of the two there is a cottage with an electricity connection and stone outbuildings. Elevated land with a high-standard of fencing, is offered in Lot 2.The balance of the land is offered in Lot 2 and comprises of approximately 60.2ac of two nearby commonages. The larger of the two is directly north of the grassland holding, while the smaller commonage holding is a short distance to the south.

A Berkshire home set in nearly nine acres of land is on the market with a guide price of almost £4 million.

A Berkshire house set in nearly nine acres of land is on the market with a guide price of almost £4 million.

With over 7.1 million acres of rural, undeveloped land spanning New York yet median vacant property sale pricing recently averaging $230,000 statewide according to industry analyst reports, evaluating true land valuations proves tricky amidst such immense geography blended with extreme market ...

With over 7.1 million acres of rural, undeveloped land spanning New York yet median vacant property sale pricing recently averaging $230,000 statewide according to industry analyst reports, evaluating true land valuations proves tricky amidst such immense geography blended with extreme market variances between bustling NYC metro zip codes where builders bid near $1 million per acre contrasted with rural counties hugging Pennsylvania borderlines seeing sub $2,000 per acre sales.Home to the most iconic skyline in the world, the New York City metro area represents the pinnacle of high-value urban land. Encompassing the five boroughs of Manhattan, Brooklyn, Queens, the Bronx and Staten Island, along with nearby counties in Long Island, Westchester and New Jersey, the marketplace here spans an immense scale.Average per acre prices range from around $50,000 in cities like Schenectady to over $200,000 for prime Buffalo land. Developers targeting upstate urban markets need to research population and job growth trends, inventory of existing buildings, and demand drivers by sector.Comparable sales research is critical when evaluating Buffalo land. Rochester is attracting tech firms and redevelopment near the universitites. Inner-city parcels can reach $150,000 per acre while suburb rates are $50,000-$100,000 per acre depending on attractiveness. Rochester's market requires deep study of economic health.

A plot of land in Westbury with planning permission to be turned into three large homes has gone on the market for a total just shy of £500k.

The plot of land is located at Courtleigh House, Westbury Leigh, accessed via a drive past the Hollies Inn. The development opportunity is on the market for £495,000 and is being marketed by Cooper and Tanner.

After two years of frantic competition, demand for residential land has fallen as developers face lower sales and dwindling profits.

Experts at the company found that demand for residential land across the U.S. has fallen by nearly two-thirds, with only 28 percent of land brokers reporting strong demand for lots in the second quarter of 2025, down from 76 percent a year earlier. This drop in demand, experts say, suggests that new home construction in the country is likely to slow down in the coming months as developers adjust to making lower profits on the market.Dillan Krieg, senior research analyst at JBREC, told Newsweek that demand has fallen mainly because builders are pulling back from the land market.Krieg sees the fall in land sales as signaling a slowdown for the U.S. housing market."The new home market has been sluggish this year, with falling sales and high inventory pushing prices down," Krieg said. "Builders, who already control plenty of land, are slowing new home starts and land purchases.

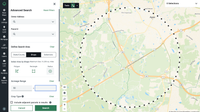

Learn how to find and close off-market land deals in just 5 steps using Acres. Streamline your land search and outreach with one powerful platform.

Streamline your land search and outreach with one powerful platform. ... Finding off-market land deals takes more than luck—it requires strategy, data, and speed. Acres.com helps land professionals streamline their search, uncover high-potential properties faster, and pre-qualify opportunities based on real criteria.This guide walks you through a 5 step strategy to search, vet, and act on land opportunities before the competition. Step 1: Define Your Criteria and Use Layers to Pre-Qualify Parcels ... The key to off-market success is narrowing in on the right properties.If you're doing targeted outreach, understanding land values before contacting owners helps you craft a more compelling, credible, and realistic offer. Acres equips you with data and tools to generate instant valuation reports that reflect real market conditions.With Acres, you can do it all in one place—search, vet, value, and share land opportunities without bouncing between tools or data sources. The result? A repeatable, scalable strategy backed by data to find and close land deals. Start building your off-market pipeline today at Acres.com.

Zepto and HoABL are bringing digital land buying to the masses. Through the Zepto app, users can quickly connect with HoABL experts, explore Vrindavan plots, and make bookings with refundable token payments, marking a unique intersection of quick commerce and real estate

Tata Motors CFO P B Balaji Appointed CEO of Jaguar Land Rover — All You Need to Know About Him · Lohia Worldspace to Invest ₹200 Cr in 1st Housing Project at Moradabad · Gaurs Group to Invest ₹1,400 Cr to Build New Housing Project in Yamuna Expressway Region · House of Abhinandan Lodha Partners with Zepto to Market Housing Plots“We are on a mission to democratise land ownership for Indians with our fully seamless and transparent digital-first model. Our shared vision with Zepto to make our respective offerings easily accessible through a convenient process makes this partnership very natural,” Jain added. Gaurs Group to Invest ₹1,400 Cr to Build New Housing Project in Yamuna Expressway Region · House of Abhinandan Lodha Partners with Zepto to Market Housing PlotsZepto has entered the real estate space by partnering with HoABL, enabling customers to discover and reserve plots in the Vrindavan project through its app. The process, including expert consultation, can be completed in minutes, with a flexible payment structure designed to ease entry into land ownershipQuick commerce major Zepto has partnered with a real estate developer ‘The House of Abhinandan’ to offer land investment opportunities directly to consumers’ fingertips, and that too, within few minutes.

The leading real estate marketplace. Search millions of for-sale and rental listings, compare Zestimate® home values and connect with local professionals.

Over the past decade, average cropland ... data from Kansas State University, dryland cropland in the state saw a statewide average price increase of 9% in the past year, rising from approximately $2,350 per acre in 2021 to $2,565 per acre....

The market for vacant agricultural land, ranch acreage and rural residential plots in Kansas continually evolves based on macroeconomic factors influencing broader domestic real estate trends alongside localized supply-demand dynamics and land utilization shifts.Over the past decade, average cropland values in Kansas have shown a gradual upward trajectory, with some year-to-year fluctuations. According to 2022 land market survey data from Kansas State University, dryland cropland in the state saw a statewide average price increase of 9% in the past year, rising from approximately $2,350 per acre in 2021 to $2,565 per acre.However, these statewide cropland averages mask significant regional value differences within the diverse Kansas land market. In Northwest Kansas, poorer soil quality and lack of access to aquifers and water resources depresses cropland values far below state-level pricing.As one moves into Central and Eastern Kansas, factors like improved soil, adequate rainfall and irrigation capabilities boost land valuations considerably. Examining price history and regional land value maps can pinpoint local market norms.

Marketland Biggest shopping mall in the city Play Marketland to run the biggest shopping mall in the city! Start with a small corner shop and convert it to a supermarket or a huge shopping mall visited by fun customers of all types! Order, display and sell various products for non-stop customer

Ag land values continue to hold steady amid economic uncertainty and low grain prices, Farmers National executive says.

Arkansas, Biz News, Colorado, Corn, Crops, economy, Farmland, Iowa, Kansas, Land, Minnesota, Missouri, Montana, Nebraska, New Mexico, Oklahoma, Ranchland, Real Estate, South Dakota, Soybeans, Texas, Wheat, Wyoming ... Despite ongoing challenges in commodity markets and uncertain farm profitability, agricultural land values have remained remarkably stable through mid-2025, according to Omaha, Nebraska-based Farmers National Company.This will likely influence producer purchasing power and investor returns, especially as input costs, commodity prices, and interest rates fluctuate,” Schadegg said. “While balance sheets generally remain strong, any negative movements in the ag economy could quickly impact the land market.”Trade policies, tariffs, and global unrest create uncertainty, impacting both domestic and international markets. While renegotiated trade agreements may present future opportunities, current tariffs could decrease demand for U.S. agricultural exports as other countries expand their production and infrastructure. · Looking into the second half of 2025, those with solid financial positions—both producers and investors—will be best equipped to pursue land purchase opportunities.During periods of volatility, Farmers National Company sees strong demand for real estate and management services as landowners seek answers in today’s market.

In 2023, land transactions of REALTORS® survey findings indicated a growth of 1.2% in land sales. Although this marks a slower pace compared to past performance, it highlights the market's resilience and ongoing potential for expansion amidst challenging conditions.

In 2023, land transactions of REALTORS® survey findings indicated a growth of 1.2% in land sales. Although this marks a slower pace compared to past performance, it highlights the market's resilience and ongoing potential for expansion amidst challenging conditions.Land sales generally conclude within a 60-day period, while a notable 25% of these transactions are wrapped up in less than 30 days. Particularly in regions 1, 2, 3, 7, 9 and 10, the market moves even faster, with most sales closing in under 45 days.According to NAR’s estimate, the land value accounts for 41% of household real estate assets based on Federal Reserve Board data on household real estate and the cost of structures.Whether you’re a new agent or an experienced broker you have access to a wide array of resources designed to help you succeed in today's market.

“The market will increasingly bifurcate into those seeking highly efficient premises and those who seek to mitigate rental cost at the expense of optimisation and technology adaptation.” · The ‘From Surge to Stabilisation’ report found land values, particularly for serviced land, ...

“The market will increasingly bifurcate into those seeking highly efficient premises and those who seek to mitigate rental cost at the expense of optimisation and technology adaptation.” · The ‘From Surge to Stabilisation’ report found land values, particularly for serviced land, will continue to remain robust.Home / Markets / Industrial / What’s Next for Rents, Land Values and Development in Australia’s Industrial Market?Australia’s industrial property market boomed post-COVID, but with vacancy rates normalising, what lies ahead for demand, rents, and supply?Over the past five years, East Coast land values have increased by 46% to 118% for small blocks and 46% to 131% for bigger lots of 1 to 5 hectares. Recently values have plateaued in Sydney and Melbourne but have held firm overall.

Land Sales: Generational turnover will lead to large land availability.

That’s a lot of land. Of course, not all those acres will hit the open market. From what I know about family farms and production agriculture, most of that land will stay in the family or be sold privately to existing tenants. Still, the numbers don’t lie.We talk about what’s working, what isn’t and what’s happening in our local markets. Related:U.S. sunflower acres continue to grow · Interestingly, while we’ve seen some softening in the I-states and the Dakotas, auctioneers out East are not seeing a slowdown. One Ohio colleague told me, “Land just keeps going up.” I heard the same from folks in Indiana, Michigan and throughout the eastern seaboard.From a land market perspective, that means an estimated 300 million acres could change hands over the next decade.It’s said we are in the midst of the greatest wealth transfer in history. Baby boomers, many of whom became incredibly wealthy through owning land, growing a business or preserving older wealth, are gradually transitioning assets to the next generation.

New York land market insights and values reveal a state of dramatic extremes: Queens County land sells for $6.1 million per acre while rural parcels go for under $5,000. This county-by-county breakdown helps you navigate this complex landscape – whether you're targeting NYC's intensity, the ...

New York land market insights and values reveal a state of dramatic extremes: Queens County land sells for $6.1 million per acre while rural parcels go for under $5,000. This county-by-county breakdown helps you navigate this complex landscape – whether you're targeting NYC's intensity, the Hudson Valley's balance, or upstate's exceptional value.The 300-day gap in Days on Market between fastest and slowest counties requires entirely different strategies depending on your target location. Data Source: All land pricing data in this article was compiled from multiple real estate sources including Redfin, Zillow, and local MLS listings, with data subject to change based on market conditions.When you're scoping out New York's land markets, turnover ratio is your most reliable indicator of what's really happening on the ground. It's simple—the percentage of listings that actually sell within a year.According to Jonathan Miller, President and CEO of Miller Samuel Inc., a leading New York real estate appraisal and consulting firm, "The land market surrounding New York City has reached unprecedented velocity.

The land market value in Telangana is the government-fixed property valuation (guideline value or circle rate) used for property registration and stamp duty

Extent & Boundaries – Area covered by land or house. Guideline Value / Circle Rate – Official rate fixed by government. Market Valuation of Property – Used for registration and taxation.The land market value in Telangana is the government-fixed property valuation (guideline value or circle rate) used for property registration and stamp duty calculation.Land Market Value = Guideline Value / Circle Rate fixed by the government.You can check the land market value of property online using your survey number through mypatta.

Land markets refer to the economic systems where land is bought, sold, and speculated upon, often influenced by factors like limited availability of affordable housing and the transfer of agricultural land to urban areas.

Under state socialism, urban land and housing markets did not exist. Before the transition to capitalism almost all housing was state owned and city governments restricted residential mobility as a way to tackle housing shortages. People lived in the same place for long periods and neighborhood change was slow.Nevertheless, while individual choice has been enhanced for those able to participate in the housing market, state planning control of zoning regulations and real estate taxes (coupled with a limited private mortgage system and declining real incomes for the majority) ensure that in the short to medium term at least, the social geography of Russian cities will continue to be influenced strongly by the local government. As in the former Soviet Union, in China the declining role of state enterprises in the economy, the introduction of land and housing markets, and the opening up of cities to foreign investment has meant that the state and centrally planned economy have a much reduced influence on urban development.The forest sector has adaptation or adjustment mechanisms that may help to mitigate climate change impacts, including land-market adjustments, interregional migration of production (e.g., northerly migration of productive capacity), substitution in consumption between wood and nonwood products (reflected in overall growth in wood product use) and between sawtimber and pulpwood, and alteration in forest management among owners and regions.From a human economic perspective, one of the most pertinent factors in land-use decisions is land value. Determinants of land markets have been extensively studied to quantify individual preferences for property attributes. One commonly employed method, hedonic analysis, uses the sale price of a parcel as a proxy for measuring individual willingness to pay for structural and locational property variations.